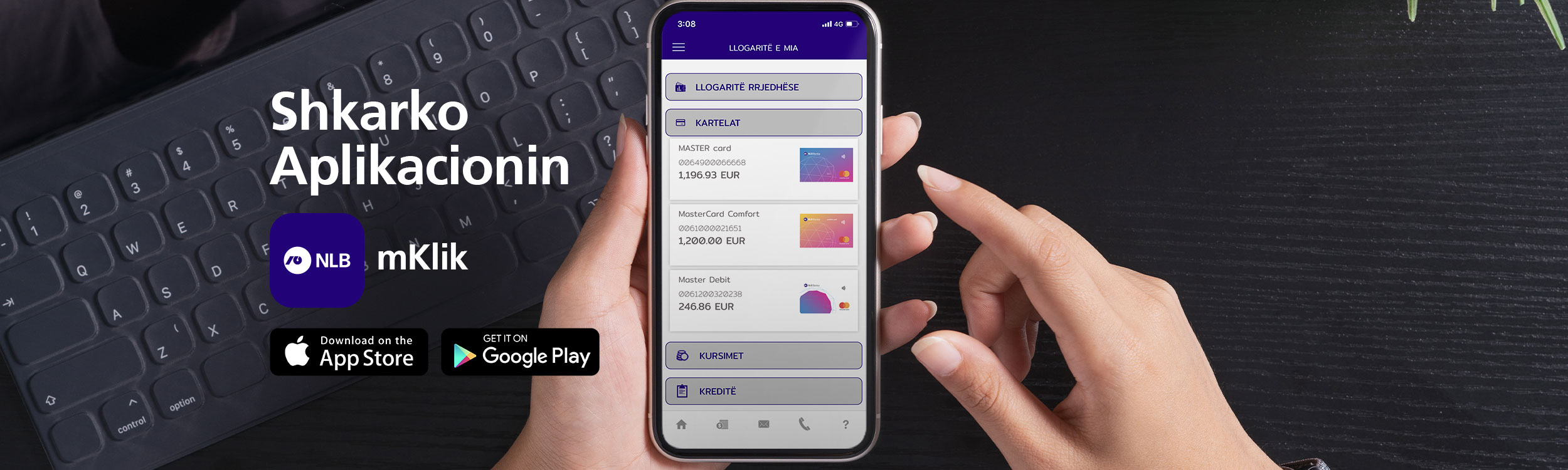

NLB m-klik - Mobile Banking

The m-klik service is the version for mobile phones of the e-klik service, which enables you to access some of the features of the e-klik service with high security during use.

The m-klik service is the version for mobile phones of the e-klik service, which enables you to access some of the features of the e-klik service with high security during use. Bring your banking services to your fingertips with NLB M-Klik.

With the redesigned application for online banking, you can perform your banking services quickly and easily.

All you need is to download the NLB m-klik application on your smartphone.

This banking service offers you secure access to your account. Your banking structure is now all in your hands.

Download:

- iOS: https://apps.apple.com/us/app/mklik-nlb-kosova/id1488747977

- Google Play Store: https://play.google.com/store/apps/details?id=hr.asseco.android.jimba.nlbpr.production

Main features of m-klik:

- Customs Payment

- Payments for sanitary

- Payments for taxes and TAK contributions

- Municipal Payments

- Electricity payments with a barcode reader

- International payments

- Third party credit card payment.

- SMS Top Up and Pre Paid services such as TV, Internet and Duo TV.

- Locations of ATMs and branches on the map.

- Loans and deposits calculator.

- Blocking and activation of cards for ATM, Online Payments and International Payments.

- Changing the card limit at the ATM and POS.

Follow 4 easy steps, and you will have the bank in your pocket!

Follow 4 easy steps, and you will have the bank in your pocket!

- Sign the agreement for the m-click service

For m-klik, you must conclude an agreement by applying at any branch of NLB Bank.

- Install NLB mklik on mobile phone

After signing the contract, you will receive the SMS message containing the activation codes of NLB m-Klik.

- Download the activation code

Activation codes are numbers used to activate the m-klik application.

- Enter the activation code

At the first login to the m-klik service, you must enter the activation codes. By doing so you will immediately be given the opportunity to set your PIN number from four to eight digits (PIN) for Android phones and six-digit number for iOS phones, which in the future will be used to access NLB m-klik . But the equipment with the m-klik service can now be done with e-klik credentials but also with the third method, applying with personal data.

With m-klik, you can check the liabilities that will be charged to your account during the next month – the costs for credit cards, monthly payments, as well as interest.

For the loss or theft of your mobile phone, which you use for the m-click service, you must notify the Bank by calling 038 240 230 100 or the toll-free number 0800 50 444. Bearing in mind that the person who has it your mobile phone does not know the PIN to access the service, your m-click is still safe.

The m-click PIN must be saved because it is your signature.

Do not show it or make it available to other people.